IIB’s Q2FY21 result was in line with our expectations operationally, and we think IIB is heading in the right direction, with: (i) focus on building granular deposits; (ii) building provision buffers; (iii) de-bulking fees; and (iv) reducing risk profile in the corporate segment. Provision cover improving to 77%, COVID provisions of Rs 21.5 bn (1.1% of loans) with guidance of continued provision build-up and collection efficiency improving to 95% provide some comfort. Also, 8-9% q-o-q deposit/CASA growth, lower IB fees are aiding granularisation of the business model.

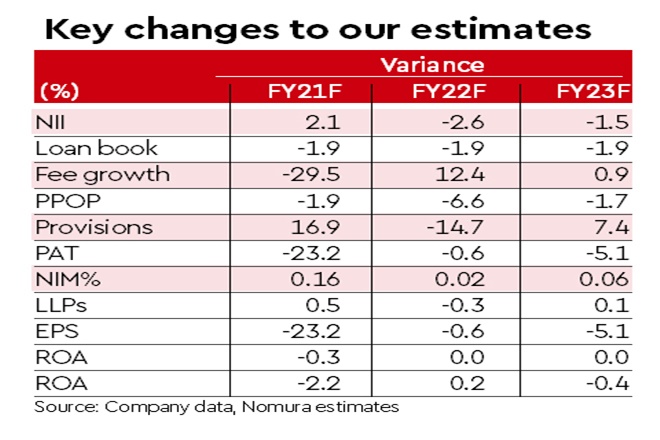

We build in credit cost of 310/190bp for FY21/22F, normalising to 140bp in FY23F and build in loan growth of 4%/12% for FY21/22F with ROEs of 8%/12% in FY21/22F normalising to 14% in FY23F. Current valuation at 1xFY22F P/BV is inexpensive especially in the context of improving granularity of B/S and P&L. We hence maintain Buy and raise our TP to Rs 725, implying 1.2x Sep-22 book.

Key highlights of the quarter

(i) Loan growth of 1.6% q-o-q was driven by vehicle finance book growing 3% q-o-q, while MFI book contracted 5% q-o-q given lower disbursements; (ii) deposits grew 8% q-o-q with CASA growing 9% q-o-q. More importantly, deposits/CASA has grown 13% from Q420 levels; (iii) excess liquidity led to NIMs contracting 10bp q-o-q but with deposit rate cuts and high yielding MFI/CV disbursements picking up NIMs should stabilise going forward; (iv) fees are still weak (down 28% y-o-y) but bulky fee contribution was significantly lower; and (v) weak fees and some compression in NIMs led to flat y-o-y core PPOP – in line with our expectations.

Asset quality highlights

GNPLs were flat q-o-q at 2.2% and, adjusting for Supreme Court order on NPA recognition standstill, GNPLs would have been 2.3%. Collection efficiency improved to ~95% in Sep, improving further in Oct. IIB expects restructuring at low-single-digits and continues to upfront provisioning with COVID provisions now at 1.1% of loans (Rs 9.5 bn in Q2) made especially for CV/MFI book and PCR improved to 77% (63% in Q4). This, in addition to core PPOP/assets of ~3.1-3.2% (FY21/22F) provide the necessary comfort.

Valuation remains comfortable

With headwinds around liabilities easing and collection efficiency improving, we find current valuations at 1x Sep-22 book undemanding. We maintain Buy, with an increased TP of Rs 725/share, implying 1.2x Sep-22 book (earlier 1.1x Jun-22F book).