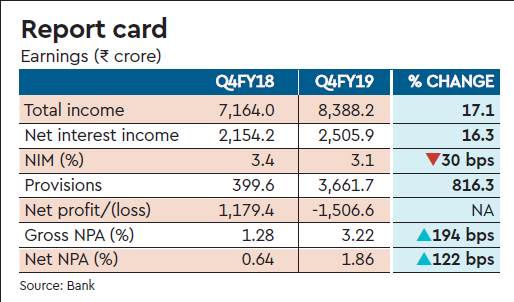

Yes Bank on Friday reported its first-ever quarterly loss of Rs 1,506.64 crore in Q4FY19 due to higher contingent provisions made towards stressed but performing accounts. Among the major exposures that the private-sector lender provided for were IL&FS and Jet Airways. The slippages during the March quarter amounted to Rs 3,481 crore.

Provisions grew by 816.2% year-on-year (y-o-y) to Rs 3,661 crore with contingent provisions amounting to Rs 2,100 crore. Asset quality deteriorated with gross non-performing assets (NPAs) at 3.22%, or Rs 7882.56 crore, an increase of 112 basis points (bps) quarter-on-quarter (q-o-q). Net NPAs at Rs 4,484.85 crore rose 68 basis points q-o-q to 1.86%.

Also read: Uber may not reach $100 billion valuation with target share price of $44-$50 for IPO

The lender’s pre-provisioning profit fell by 38% y-o-y to Rs 1,323 crore on account of a 40.5% increase in its total expenditure. The net interest income (NII) rose by 16.3% y-o-y to Rs 2,505.9 crore in Q4FY19 while the net interest margin (NIM) fell by 30 bps sequentially to 3.1%.

Total advances as at the end of March stood at Rs 2.41 lakh crore, up 18.7% y-o-y but fell by 1% q-o-q from Rs 2.43 lakh crore in Q3FY19. The bank’s capital adequacy ratio (CAR) stood at 16.5% under Basel 3 against 18.4% a year ago.

The minimum CAR under Basel 3 norms stands at 10.5%. Total deposits rose 13.4% y-o-y to Rs 2.27 lakh crore. The current accounts savings accounts (CASA) deposits grew by 2.8% y-o-y, while the CASA ratio fell marginally to 33.1% in Q4FY19 against 33.3% in the previous quarter.